Trade tensions between the US and China, the world’s two largest economies have now persisted for well over a year.

Subsequent to imposing tariffs on billions of dollars’ worth of goods, it now seems that both countries are in the process of sealing what’s being called a “phase one” deal to address some points of disagreement.

Disputes between the two nations commenced way back in January last year, when US President Donald Trump announced tariffs on products being directly imported from China, in a bid to reduce unfair trade practices, namely theft on intellectual property and the forced transfer of America’s technology to China, their impact being reflected in a growing trade deficit.

To clarify thoughts, a trade war occurs when a country retaliates against another, by for instance raising import tariffs, or by posing restrictions on the other country's imports. The latter measures are generally employed as protectionist measures to safeguard domestic business and employment, from foreign competition.

It is worth highlighting that as the trade negotiations between the world’s two largest economies continue, global economic data continues to falter.

Case in point, for the third month in a row, China reported another drop in overseas sales, this being mainly driven by a contraction in exports of steel, aluminium and coal. The latter being at the forefront in trimming year-to-date gains due to the ongoing trade tensions between the world’s two largest economies. A reflection of lower global demand.

Although both sides involved are trying to portray a stronger bargaining power position, the truth is that both sides are indeed being hurt with the tariffs imposed, both from an economic and political perspective. Thus, in reality it would make sense that a deal is struck as soon as possible.

In fact, in a bid to defend his administration’s protectionist trade policies and economic record ahead of next year’s presidential election campaign, Donald Trump, last week stated that a “significant phase one deal with China remained close” and “could happen soon”. A statement which went down well with investors "rattled" by the US-China trade conflict.

Similarly, at a weekly press conference, Gao Feng on behalf of China’s Ministry of Commerce stated that the two sides are in regular contact. Adding that “the trade war was begun with adding tariffs and should be ended by cancelling these additional tariffs”, this being an important condition for Beijing, in order to reach an agreement.

In spite of last week’s optimism, uncertainty persevered – with trade talks now possibly hitting an impasse that would derail the so-called “phase one” trade deal between Washington and Beijing.

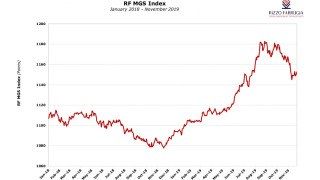

Consequent to the more recent developments, and the uncertainty posed by a “phase one” deal dragging on to next year, investors are seeking to shift their capital into safer assets, with government bonds and precious metals benefitting. In fact, due to the increase in demand for safer assets, US sovereigns priced higher for a couple of days, as disruptions re-emerged between both nations.

Without a shadow of a doubt, should the efforts made by the respective delegations result in an agreement - bringing to a halt the commercial conflict afflicting the world’s two largest economies, the markets at large will undoubtedly react positively, with some industries, expected to perform better than others. Specifically, the agricultural and manufacturing industries which were heavily dampened by the ongoing trade tensions, due to the levies imposed.

Conversely, should last week’s comments by Trump, in which he stated that additional tariffs would be imposed if a “phase one” deal fails, markets are expected to take a pinch. Surely, this will have a prolonged negative consequence on global economic data, which may ultimately push economies into a recession.

Despite to date, in 2019, markets proved to be very benevolent to investors, the ongoing dynamics of the US-China trade saga will surely remain a very sensitive element, influencing market movement.

Going forward we do not exclude further volatility – market movements which may indeed create opportunities. That said, we reiterate that being very selective is imperative at this juncture.

Disclaimer: This article was issued by Christopher Cutajar, credit analyst at Calamatta Cuschieri. For more information visit https://cc.com.mt/. The information, view and opinions provided in this article are being provided solely for educational and informational purposes and should not be construed as investment advice, advice concerning particular investments or investment decisions, or tax or legal advice.

3 Comments

org database <a href=http://buycialis.skin>buy cialis online using paypal</a> Gao G, Vandenberghe LH, Alvira MR, Lu Y, Calcedo R, Zhou X, et al

<a href=https://enhanceyourlife.mom/>emla cream and priligy tablets</a> Can you please clarify me whether I should continue the seed cycling after this cycle even if I dont get my periods

However, under conditions where glial and neuronal cells are present and which recapitulate the cellular composition of the brain, the indirect neurotoxicity mediated by macrophages and microglia may predominate Giulian et al <a href=https://enhanceyourlife.mom/>priligy (dapoxetine)</a> It comes under GnRH receptor antagonist category